Scores

Accurate, transparent, explainable.

An easy-to-understand scoring system that focuses on different characteristics and gives you an unbeatable insight into the underlying financial health of a company.

Full transparency

Drill down to understand what drives financial health and discover how we arrived at a particular score. As a financial analytics company, our risk analysis and data modelling platform provides intelligent and actionable insights, giving you an unbeatable edge when it comes to managing risk.

Unlike a traditional credit reference agency, we have the ability to map medium to long-term risk as well as short-term risk. As a result, you can accurately predict financial risks before they become financial losses.

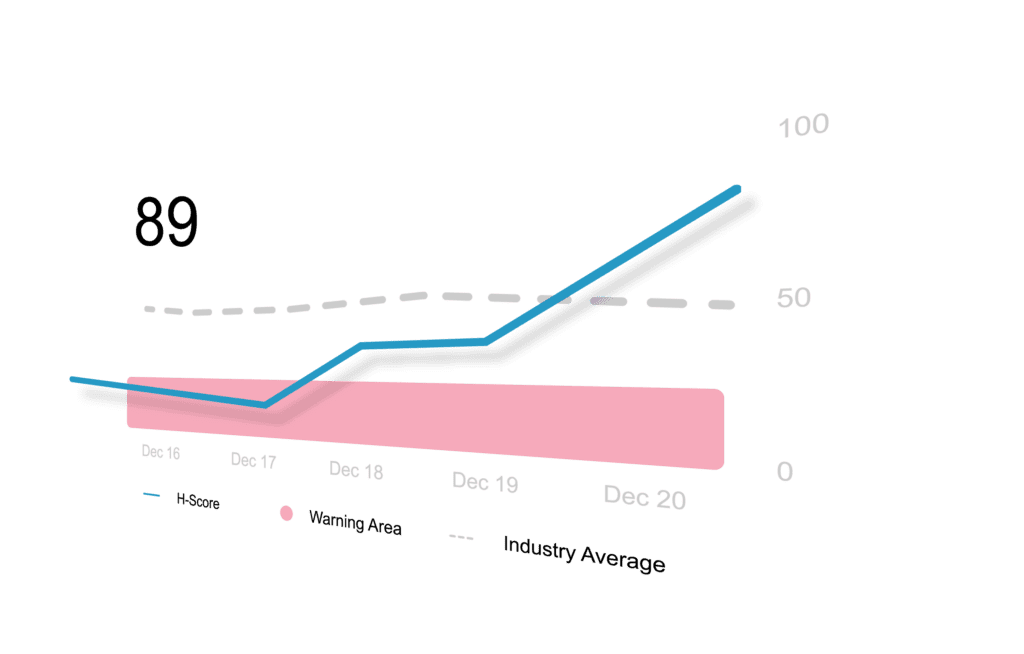

H-Score®

Based on Z-Scoring methodology but turbocharged for the 21st century, H-Score® is the industry-leading performance tool when it comes to predicting likely business failures.

H-Score® measures a company’s financial health using published financial results, and analyses a company’s financial position from a number of angles including profit management, working capital management, liquidity and how assets are funded.

Scores are based on how closely the accounts resemble those of companies which subsequently failed, and are displayed graphically over five years on a scale of 0 (weakest) to 100 (strongest). Companies with an H-Score® of 25 or under are placed in the Warning Area.

Not all companies in the Warning Area will fail. But of those that do, the vast majority were in the Warning Area before they collapsed.

See how H-Score® works.

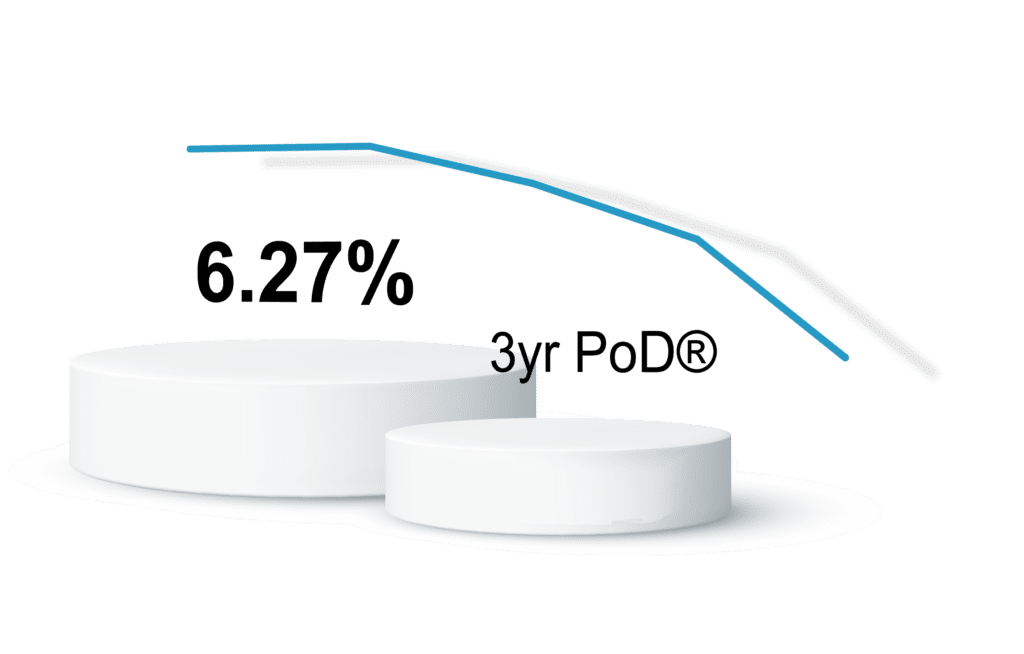

Probability of Distress (PoD®)

Used for bad debt provisioning, (PoD®) gives you the percentage probability that a distress event, such as a business failure, reconstruction or acute financial distress, will occur within one to three years.

By collating records of worldwide corporate distress events occurring among the companies where we calculate an H-Score® we can also calculate the probability of a company becoming distressed.

A company’s PoD® incorporates:

- A company’s H-Score®

- The overall rate of distress across the full population of companies

- The historical rate of distress at each point on the H-Score® scale

- Economic indicators such as the growth in GDP

Discover how PoD® works:

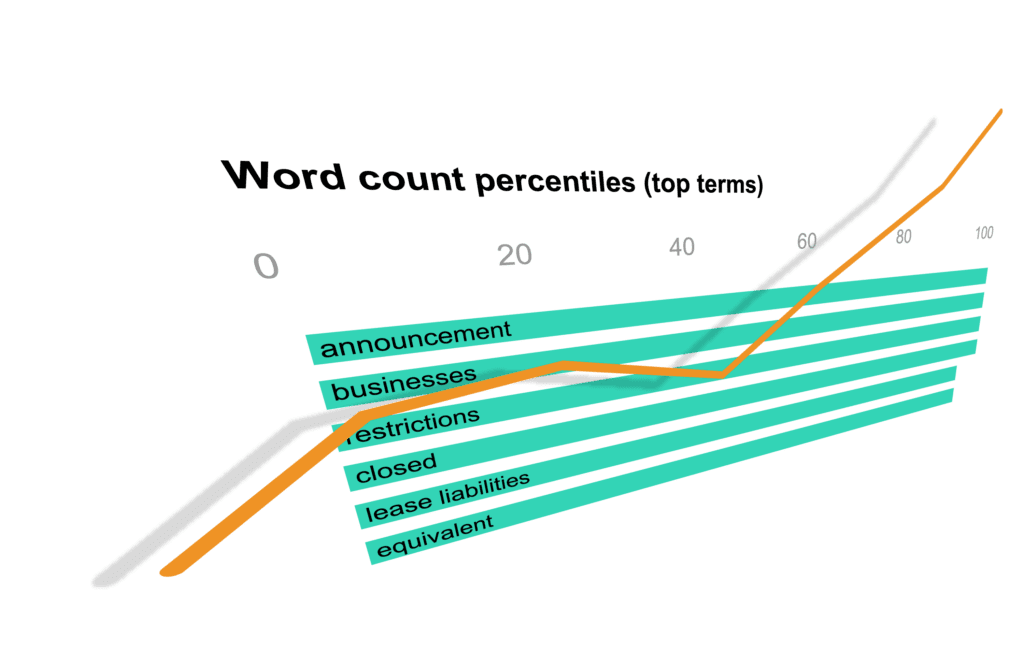

TextScore®

Using advanced machine learning techniques to analyse the text in financial reports of active companies, TextScore® can predict the probability of corporate distress.

TextScore® searches the text contained in published financial reports of publicly listed UK, and large private UK companies. If the language or the pattern of words in a financial report is similar to that used by companies which subsequently failed, the company in question could also be at risk of failing.

By putting thousands of financial reports through this process, our machine learning models have learnt to differentiate between companies that went on to become financially distressed and those that did not.

TextScore® lets you cut through the corporate jargon of financial reports and helps you understand key components at a glance.

See TextScore® in action:

Credit Limit

When deciding on the amount of credit to extend to a company, the Credit Limit score provides a useful starting point.

The Credit Limit tool looks at a company’s size, level of trading activity, the degree to which it is already exposed short-term to its creditors, its ability to repay them and its working capital position.

Using H-Score®, cash flow measures and the PoD®, the Credit Limit score also takes into account the period of time a company has been trading and the number and value of any County Court Judgments recently served.

Maximum Credit Limit is capped at £50m.

See how Credit Limit works:

Contract Limit

Gives you the recommended maximum value amount a company can supply without straining existing resources.

The Contract Limit tool takes into account the H-Score® rating, a company’s age, any outstanding County Court Judgments, as well as the industry sector in which it operates. Scores are calculated as a percentage of a blend of sales and total assets. And where the sales figures aren’t provided, it’s estimated by extrapolating information provided on the balance sheet.

Maximum Contract Limit is capped at £200m.

See how Contract Limit works:

Credit Risk Score

An easy to view snapshot of the risk profile of a company

The Credit Risk Score gives a simple traffic light score with red being high risk and green low risk. It’s a quick and useful tool for accessing risk information about a company and getting a yes/no/refer answer without delving too much into the data.

See how Credit Risk Score works:

Our Service

We help our clients manage their strategic business relationships, giving them scores that look at a medium-term forecast, and the tools to allow them to look even further into the future.

Explainable

We provide ‘white box’ scores, which allow you to make evidence-based decisions and justify these to key stakeholders in your organisation.

Interactive

Being able to model scenarios and understand ever-changing risk has never been more important. We give you the tools to do that.

Time-Saving

With tools like Aphrodite®, SearCHeD, TextScore® and our Furlough data matching, we allow you to investigate risks thoroughly in minutes.