Insurance and Reinsurance

Analyse short- and long-term risk in order to balance exposure vs reward.

Protect your business

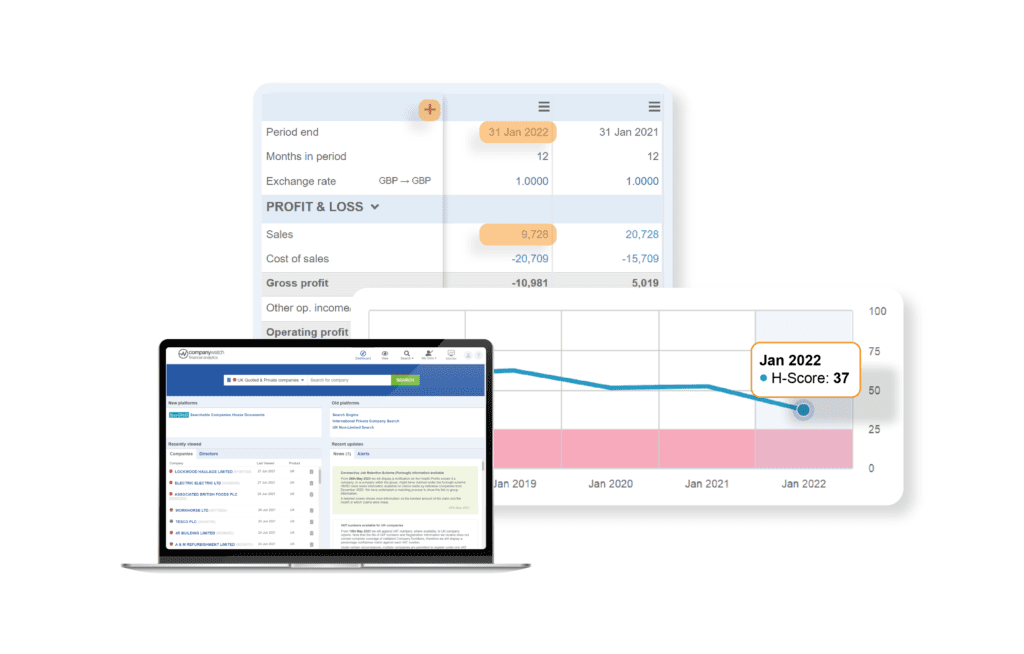

Use our financial analysis tools to assist your risk management process and use as a benchmark or combine with your internal scoring engines.

Look at long-term risks

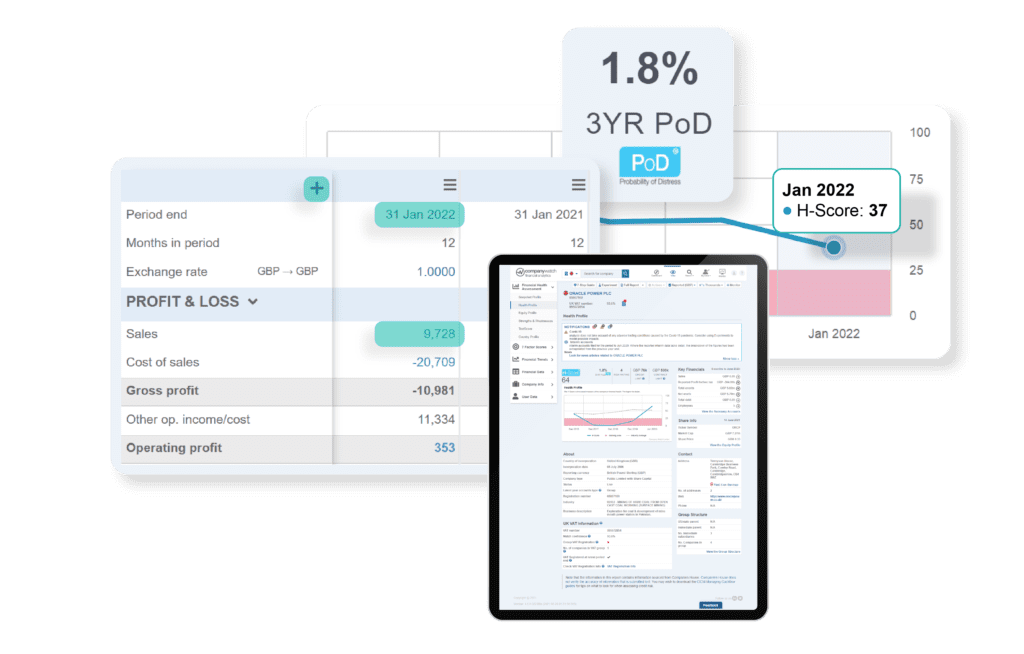

Go beyond short-term 30-60 day credit risk horizon and use H-Score®, PoD® (Probability of Distress), and the Contract Limit, combined with our forecast functionality to look at the longer-term risk horizon.

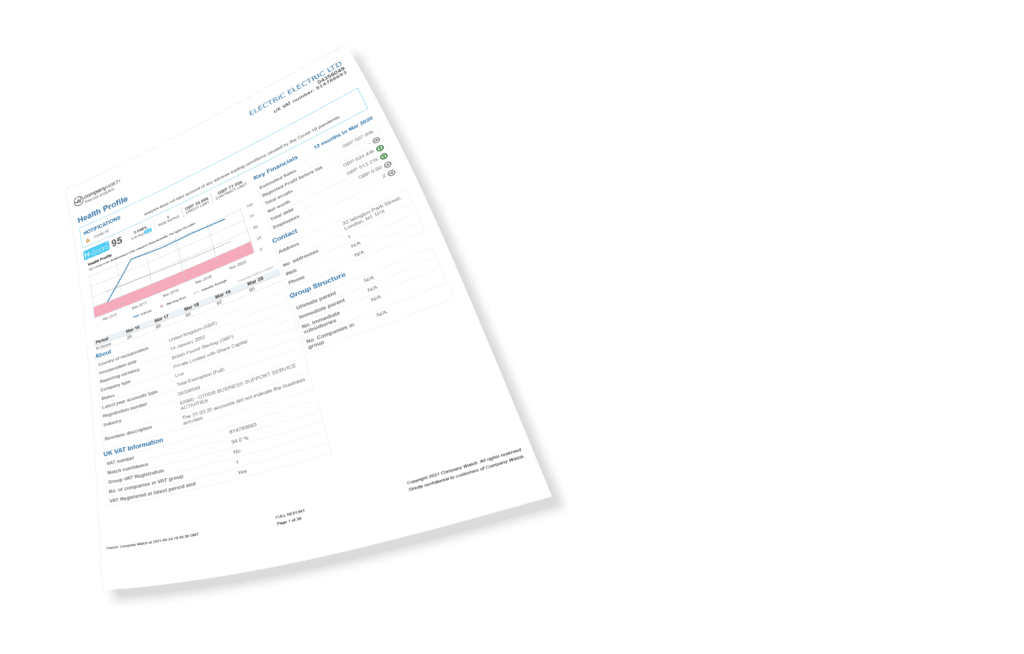

Get a snapshot of health and performance for credit committees

Use the platform to immediately access a range of customisable reports which can be downloaded and included in credit committee packs.

Monitor counterparty risk for existing insureds and prospects

Use the platform’s financial analytics capabilities to power your own product offerings, such as non-cancellable limit coverage.

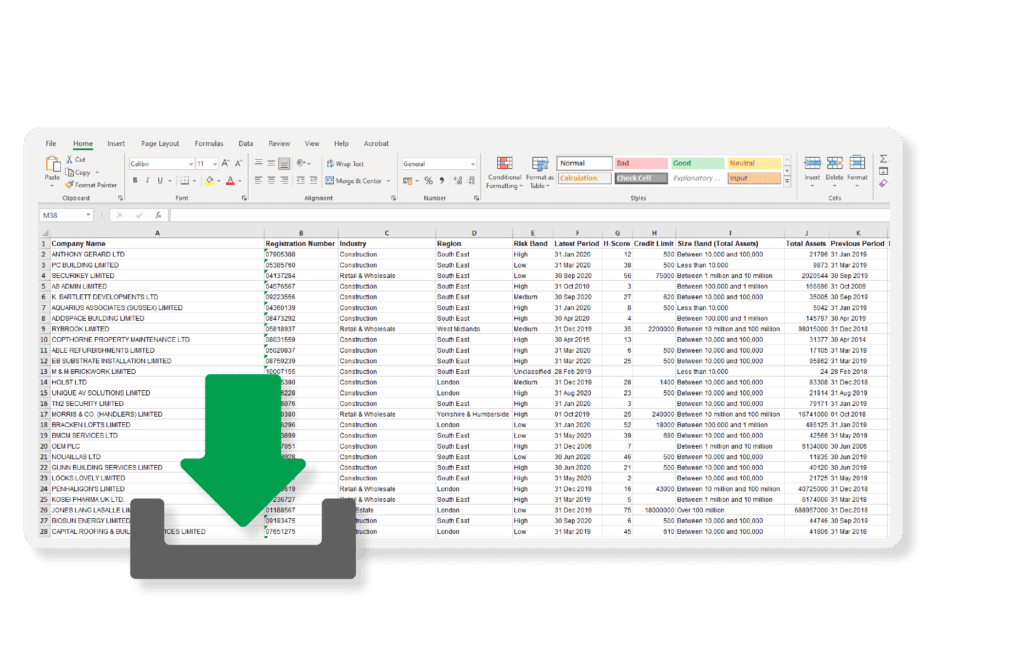

Work in a format of your choice

Download all our financial data and scores into an Excel format and customise the fields you want to export.

Our Service

We help our clients manage their strategic business relationships, giving them scores that look at a medium-term forecast, and the tools to allow them to look even further into the future.

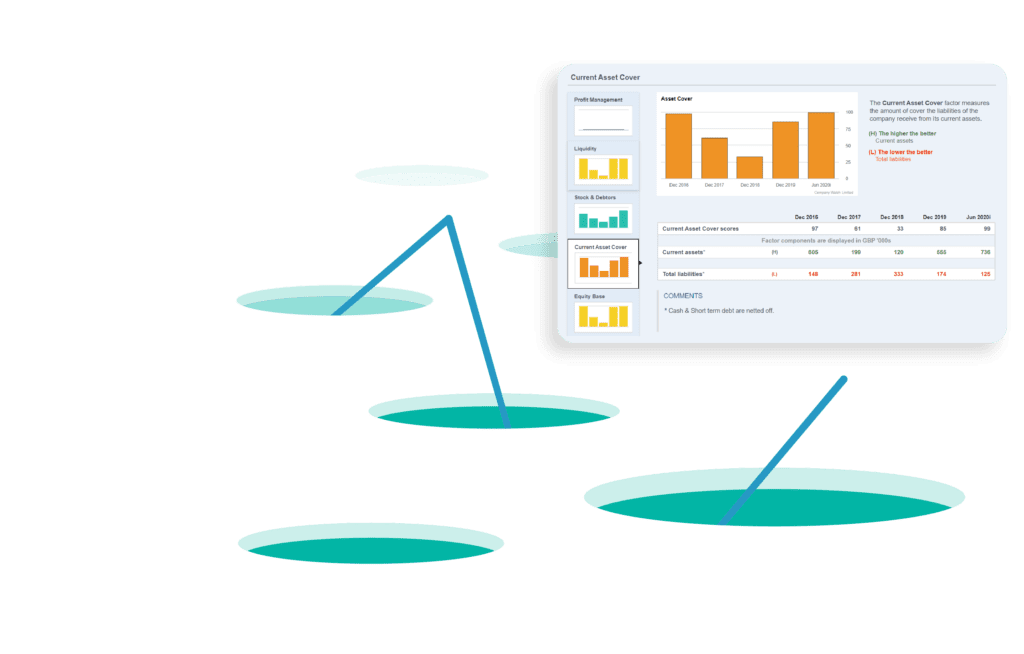

Explainable

We provide ‘white box’ scores, which allow you to make evidence-based decisions and justify these to key stakeholders in your organisation.

Interactive

Being able to model scenarios and understand ever-changing risk has never been more important. We give you the tools to do that.

Time-Saving

With tools like Aphrodite®, SearCHeD, TextScore® and our Furlough data matching, we allow you to investigate risks thoroughly in minutes.

Why choose Company Watch?

As a financial analytics company, our risk analysis and data modelling platform provides intelligent and actionable insights, giving you an unbeatable edge when it comes to managing risk.

Unlike a traditional credit reference agency, we have the ability to map medium to long-term risk as well as short-term risk. As a result, you can accurately predict financial risks before they become financial losses.

Arrange a trial

Discover how Company Watch can help you minimise your risk by using financial analytics to accurately predict company failures.