Company Credit Check

It is essential to make informed decisions when it comes to extending credit to other companies.

Confidently engage in business transactions with our specialised company credit check services. We provide comprehensive credit information, surpassing competitors to give you the edge in decision-making.

Use the best tools

Check company credit with ease. We specialise in providing comprehensive company credit information that goes far beyond that of the competition. With our company credit reports, you’ll have the information you need to make informed decisions and protect your company’s finances.

Making credit decisions in strong economies, when companies aren’t failing is easy. In times of uncertainty, where the fortunes of customers can change quickly, having the best tools available to inform your decision-making will safeguard your business.

Transparent credit scoring

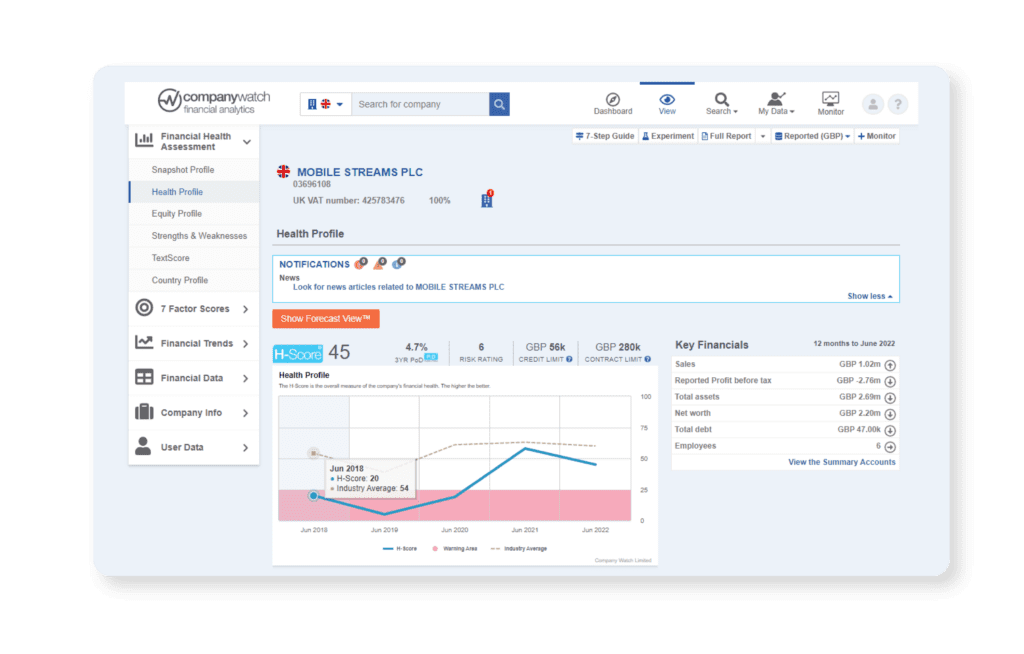

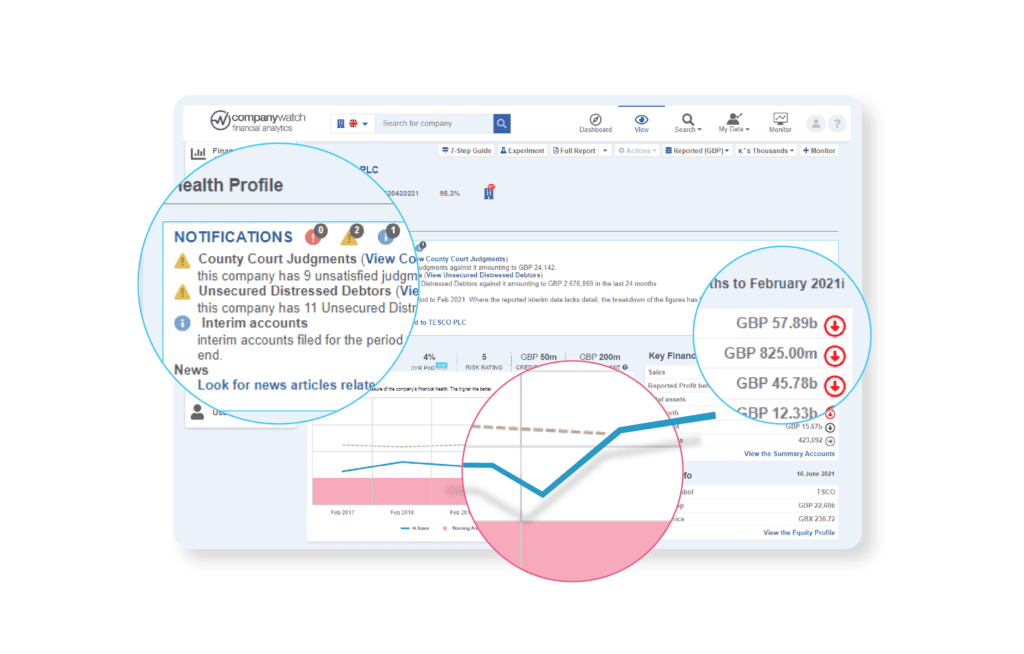

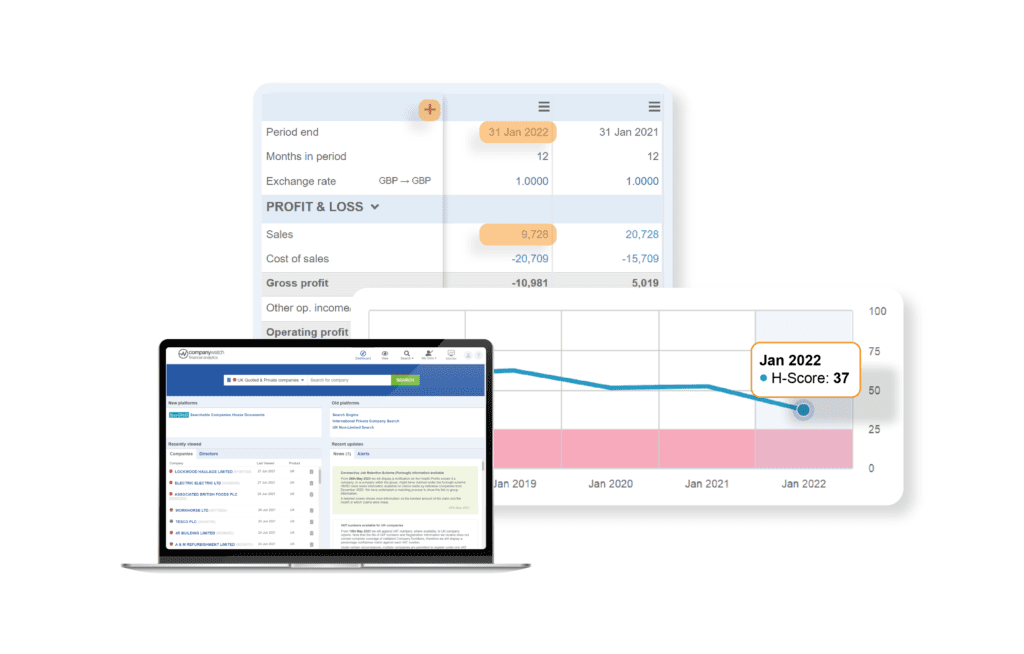

Our business credit reports are clear and easy to understand.

Headline credit scores offer quick insights, with the option for detailed analysis when required.

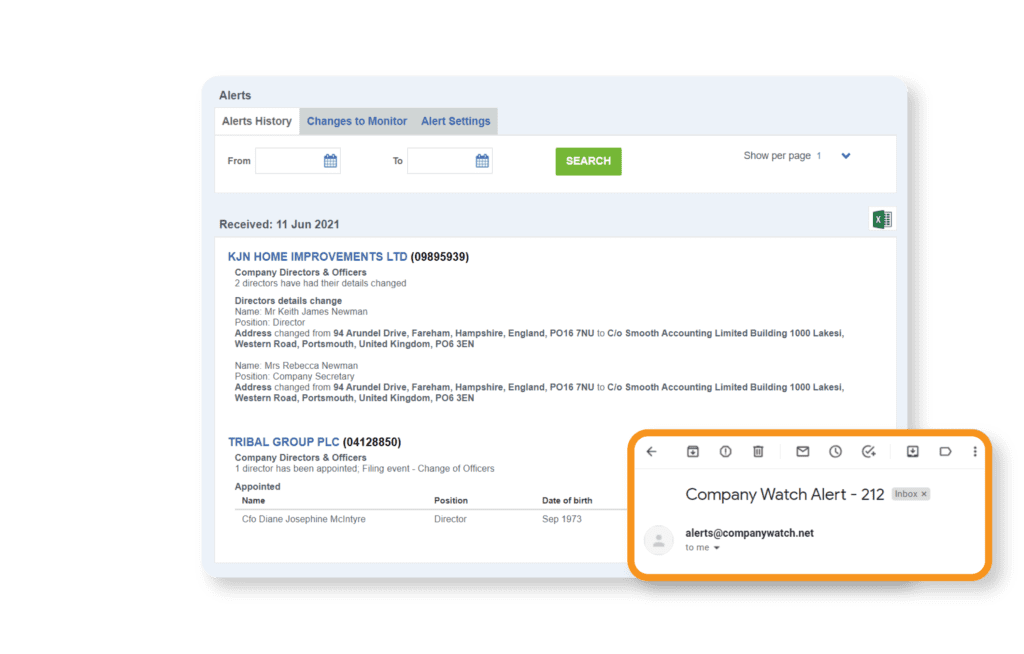

Real-time monitoring and alerts

Receive instant email alerts on changes in business credit scores, circumstances, and financial health.

Customisable alerts ensure you stay informed based on parameters crucial for your business, such as a 10-point change in the H-Score®.

The Ultimate Guide to Company Credit Scores

Dive deep into the world of company credit scoring with our ultimate guide.

Understand how credit scores are built and applied to financial risk decision-making, differentiating the approach of each credit reference agency.

Credit checking that works for you

Accurate, consistent and trustworthy information for people who need to understand the financial risks of doing business. Explore the different ways in which you can access our analytics.

Platform

Access everything you need in one place through our user-friendly platform. Simplify your credit check process with our intuitive tools.

API

Connect analytics seamlessly with your internal systems through our API. Get real-time updates and insights to make swift, informed decisions.

Scoring Gateway

Experience the power of integrating your data with our real-time scores, all made possible through our cutting-edge scoring gateway.

Why Company Watch?

Our financial risk solutions provide intelligent and actionable insights, giving you an unbeatable edge when it comes to financial risk management.

Unlike other providers, we have the ability to map medium to long-term risk as well as short-term risk. As a result, you can accurately predict financial risks before they become financial losses.

Our Service

We help our clients manage their exposure to financial risk, giving them scores that look at a medium-term forecast, and the tools to allow them to look even further into the future.

Explainable

Our 'white box' scores enable evidence-based decisions. Justify your choices to key stakeholders with transparency.

Interactive

Model scenarios and understand changing risks with our interactive tools. Stay ahead in dynamic business environments.

Time-Saving

Speed up your risk management process with tools like Director Matching and SearCHeD. Investigate risks within minutes, saving valuable time.

Frequently asked questions

A company credit check is a comprehensive assessment of a company’s financial history and creditworthiness.

It involves reviewing the company’s credit score, outstanding debts, bankruptcies, and other financial information. The information is typically gathered by credit reference agencies, like us, who collect and analyse data from various sources.

Performing a company credit check can help you:

- Reduce credit risk: A company credit check can help you identify potential credit risks before you engage in any business transactions. It can help you avoid extending credit to companies with a poor credit history or high levels of outstanding debts.

- Protect your cash flow: Extending credit to a company with a poor credit history or high levels of outstanding debts can impact your cash flow. A company credit check can help you identify companies that may struggle to pay their bills on time or have a history of defaulting on payments.

- Make informed decisions: A company credit check can provide you with valuable information that can help you make informed decisions about extending credit, entering into partnerships, or engaging in other business transactions.

We’ve written a blog explaining why it’s worth checking your own business credit score too.

Our business credit reports include information such as the company’s credit score, credit limit, contract limit, risk rating, financial statements, legal filings, and credit inquiries.

All our credit reports include a detailed breakdown of how our business credit scores are calculated – giving you full transparency in your decision-making process.

Here’s the top 5 things you should look for in your next business credit report.

To view your own business credit report, please get in touch today.

Don’t underestimate the importance of a credit reference agency.

During tough economic times, it’s natural to look for savings wherever you can. Hiring a credit reference agency may seem like an unnecessary expense, but this is a big mistake.

Skipping investing in a solid risk management solution means sacrificing long-term stability for short-term savings. Using a credit reference agency is the best way to spot future risks, helping you to steer clear of potentially catastrophic losses.

A thorough credit check, from a reputable UK credit reference agency, will pay for itself many times over.

Relying solely on Companies House for information isn’t enough. Read why you should invest in a good credit reference agency here.

We recommend conducting a company credit check before entering into any significant business relationships or transactions.

You may also want to conduct periodic checks to monitor changes in a company’s creditworthiness over time. You can set up alerts to get instant notifications of any changes to a company’s credit score.

Much more than just a credit score, our scores let you deep dive into the financial health of your customers, suppliers and other business partners.

Our Credit Risk Score takes into account the latest H-Score® as follows:

- High: H-Score® in the Warning Area (25 or less);

- Medium: H-Score® between 26-35;

- Low: H-Score® between 36-100.

The Credit Risk Score will be marked as high if a company is late filing or has any distress notification filed against it.

The notification types include late filing, CCJ, subsidiary status, distressed status, Unsecured Creditors & Unsecured Distressed Debtors, Profit Warnings for UK-quoted companies only.

Company Watch Credit Limit is a benchmark unsecured trade limit that could be used as a starting point when considering the amount of credit that should be extended to this company by a single supplier of goods, services or finance.

Company Watch Contract Limit is the recommended maximum value amount that a particular company can supply without causing a strain on the company’s existing resources. The Contract Limit takes into account the level of financial risk (including the H-Score® rating), the company’s age, any outstanding CCJs as well as the industry sector.

Multiple other factors go into our credit scoring, making us one of the most accurate risk prediction services on the market.

To get a full overview of how our credit scores are derived, please get in touch today.

A company credit rating shouldn’t be seen as a one-off purchase. It’s an investment designed to protect you against future losses. While it may be tempting to look for the cheapest rating possible, it’s important to consider what you’re getting for your money.

The cost of a company credit check will vary depending on the provider and the depth of information required. Typically, fees can range from £40-£80 for basic reports to more substantial amounts for comprehensive analysis from reputable credit reporting agencies. Many providers offer subscription plans for ongoing monitoring. It is advisable to compare pricing and services offered by different credit reporting agencies to find the best fit for your specific needs.

Read more about how much to spend on a company credit rating here.

Improving your company’s credit score involves adopting responsible financial practices. Ensure timely payments of bills and obligations to demonstrate reliability and regularly check your company’s credit reports for errors and dispute any inaccuracies. Diversify credit by having a mix of different credit types, such as trade credit and revolving credit and manage debt levels responsibly to keep the credit utilisation ratio low. If your business is new, establish a positive credit history by making small, manageable transactions and paying them off promptly. Build strong relationships with suppliers and creditors, as positive trade references can impact your credit profile. Remember, improving a credit score takes time, so be patient and consistently practice good financial habits to see positive changes over the long term.

Arrange a trial

Discover how Company Watch can help you minimise your risk by using financial analytics to accurately predict company failures.